The American South may not be the first region that comes to mind when you hear the phrase “hotbed of tech entrepreneurship,” but, slightly misguided perceptions aside, it’s home to a diverse and growing collection of startups.

Here, we’re going to take a deep dive into the startup funding data for the region.

What is “the South?”

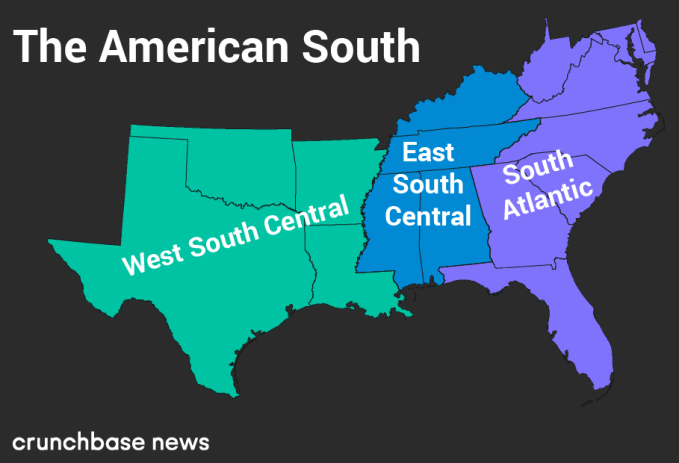

Just like it’s a common pastime for many city dwellers to argue about the precise boundaries of neighborhoods, there’s often some disagreement about the exact contours of the U.S.’s various regions. To quash rabble-rousing from the get-go, we’re using the U.S. Census Bureau’s definition of “the South” on its official map of the United States. Below, we display a map of the states we’re going to look at today.

Much like barbecue, the South is not a monolithic concept. So to incorporate some regional flavor into the following analysis, we’re also going to use the same regional divisions that the U.S. Census Bureau uses.

By doing this, we’ll be able to get a better idea of the relative contribution states from each sub-region make to startup activity in the South overall.

The ebb and flow of deal and dollar volume

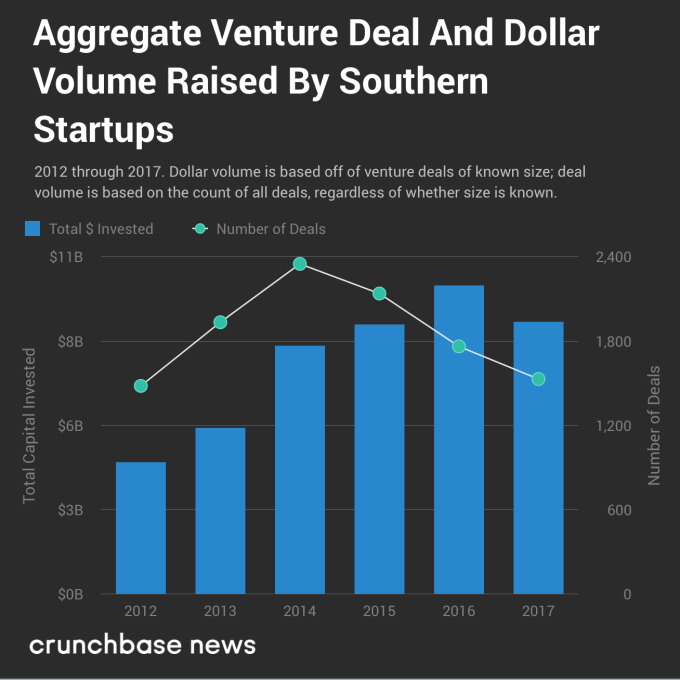

As is the case with most of the country, the South appears to be experiencing a shift in startup funding as we move toward the latter half of a bull run in entrepreneurial activity. The chart below shows a divergence in overall deal and dollar volume over time.

Much like in the rest of the U.S., reported deal and dollar volume are heading in different directions. Part of this may be due to reporting delays — it can sometimes take a few years for seed and early-stage rounds to get added to databases like Crunchbase’s. Nonetheless, there is a slow and generally upward creep in round sizes at most stages of funding. And that’s not just a Southern thing; it’s a country-wide trend.

Let’s disaggregate these figures a bit. We’ll start with deal counts and move on to dollar volume from there.

A closer look at southern venture deal and dollar volume

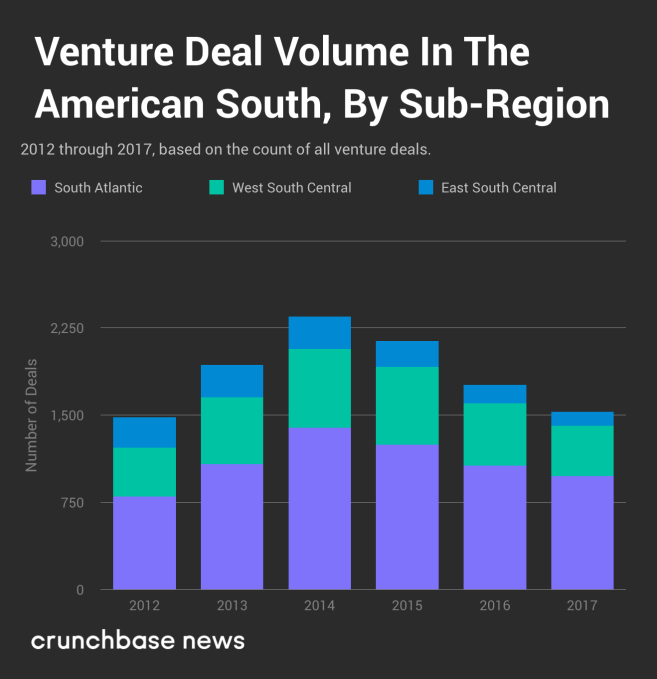

In the chart below, you’ll see venture deal volume broken out by sub-region.

Over the past several years, reported venture deal volume has been on the downswing. From a local maximum in 2014 through the end of 2017, it’s down almost 35 percent overall. But that’s not the whole picture. The relative share of deal volume has changed, as well.

Although it’s not immediately clear just by looking at the chart above, startups in the South Atlantic sub-region have accounted for an increasingly large share of the funding rounds. For example, in 2012, South Atlantic startups attracted 54 percent of the deal volume. In 2017, that grows to 64 percent. Startups in the West South Central sub-region have pretty consistently pulled in between 28 and 30 percent of the deals, so where’s the loss coming from? Startups headquartered in Kentucky, Tennessee, Mississippi and Alabama pulled in just 8 percent of deals in 2017, compared to 18 percent in 2012.

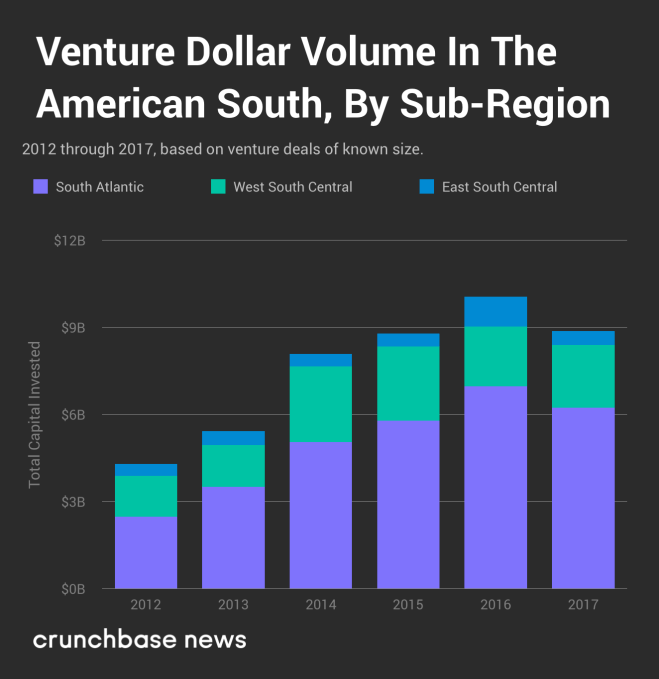

It’s a similar story with dollar volume.

In general, dollar volume follows the same pattern, albeit with a bit more variability. Regardless, startups in the South Atlantic sub-region are hoovering up an ever-larger share of venture dollars, and there’s little to indicate that trend will reverse itself any time soon.

Where are the regional hotspots for deal-making in the south?

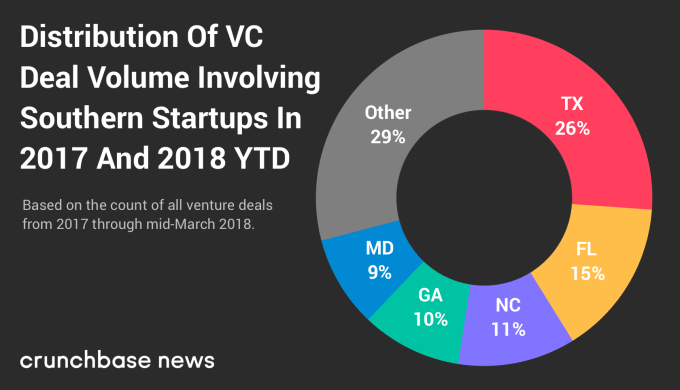

Let’s see which states accounted for most of the deal volume. The chart below shows the geographic distribution of deal-making activity by startups in each Southern state from the beginning of 2017 through time of writing. It should come as no surprise that much of the activity is concentrated in states with higher populations.

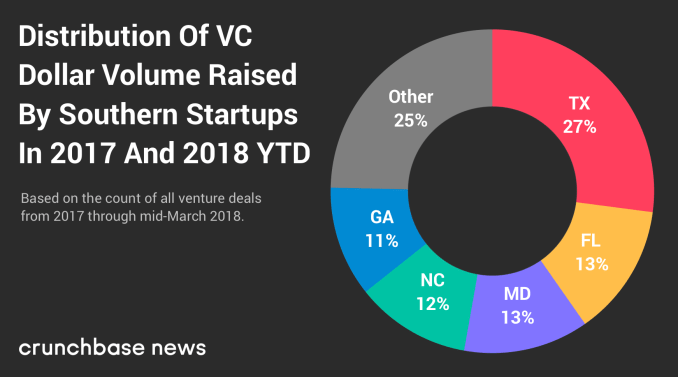

And here’s the distribution of dollar volume among southern states.

Despite some variation in which states are at the top of the ranks, the share of deal and dollar volume raised by startups in the top three states is remarkably similar, coming in at between 52 and 53 percent for both metrics.

The top startup cities in the south

We started by looking at the South as a whole and then drilled into its sub regions and states. But there’s one layer deeper we can go here, and that’s to rank the top startup cities in the South.

In the interest of keeping our rankings fresh and timely, we’re covering activity from the past 15 months or so, from the start of 2017 through mid-March 2018. But before highlighting some of the more notable hubs, let’s take a look at the numbers.

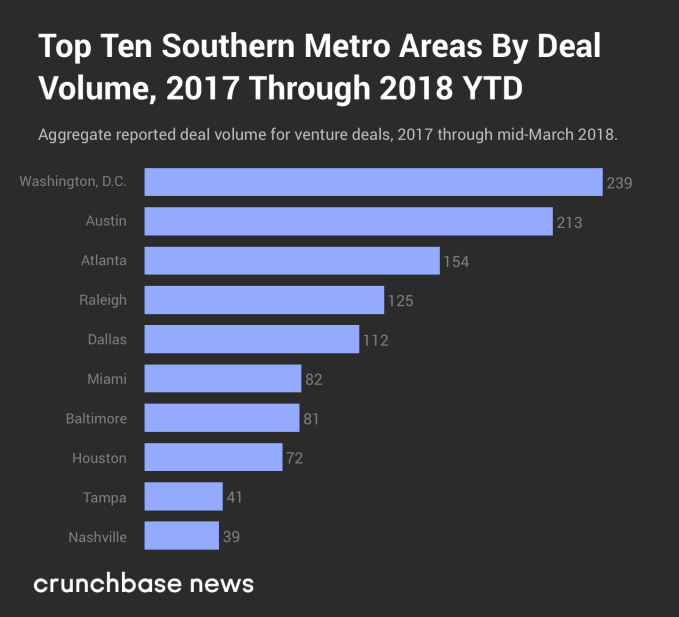

In the chart below, you’ll find the top 10 metropolitan areas where Southern startups closed the most funding rounds.

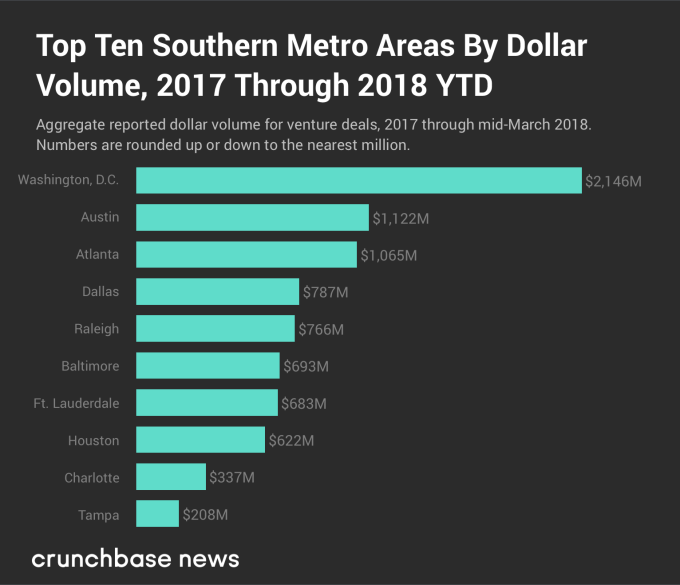

The chart below shows reported dollar volume over the same period of time.

Much like we saw at the state level, the top five startup cities — ranked by both deal and dollar volume — are the same, although there’s some variation between where each one ranks. In order, the D.C., Austin and Atlanta metro areas rank in the top three for each metric, while Dallas and Raleigh, NC switch off between fourth and fifth place.

Startups capitalize on the nation’s capital

To be frank, Washington, D.C.’s top-shelf ranking was a bit of a surprise. It may be the fact that Austin, TX plays host to South By Southwest, a somewhat more relaxed culture and/or a preponderance of excellent breakfast taco and barbecue joints, but to many — ourselves included — the city feels like it would have a more active startup scene than the nation’s capital. But that’s not exactly the case. The D.C. metro area had more venture deal and dollar volume than Austin for seven out of the last 10 years, and startups based in the nation’s capital have raised more than twice as much money so far in 2018.

D.C.-area startups have recently raised some notable rounds. Just a couple of weeks prior to the time of writing, Viela Bio raised $250 million in a Series A round (in late February 2018) to continue funding research and testing of its treatments for severe inflammation and autoimmune diseases. And on the later-stage end of things, education technology company Everfi raised $190 million in a Series D round that had participation from Amazon founder and CEO Jeff Bezos, former Alphabet executive Eric Schmidt and Medium CEO Ev Williams. Other D.C. companies, including Mapbox, Upside.com, Afiniti and ThreatQuotient, have all raised late-stage rounds within the past 15 months.

Startup ecosystems in Southern cities may pale in comparison to places like New York and San Francisco, but it wouldn’t be wise to discount the region entirely. A large number of interesting companies call the lower half of the Lower 48 home, and as the cost of living continues to rise on the east and west coasts, don’t be surprised if many current and would-be founders opt to stay down home in the South.

from Startups – TechCrunch http://ift.tt/2FQZy0Q

via IFTTT

No comments:

Post a Comment

Thank You for your Participation