Hello and welcome back to Startups Weekly, a weekend newsletter that dives into the week’s noteworthy startups and venture capital news. Before I jump into today’s topic, let’s catch up a bit. Last week, I wrote about a new e-commerce startup, Pietra. Before that, I wrote about the flurry of IPO filings.

Remember, you can send me tips, suggestions and feedback to kate.clark@techcrunch.com or on Twitter @KateClarkTweets. If you don’t subscribe to Startups Weekly yet, you can do that here.

What’s new?

Peloton revealed its S-1 this week, taking a big step toward an IPO expected later this year. The filing was packed with interesting tidbits, including that the company, which manufacturers internet-connected stationary bikes and sells an affiliated subscription to its growing library of on-demand fitness content, is raking in more than $900 million in annual revenue. Sure, it’s not profitable, and it’s losing an increasing amount of money to sales and marketing efforts, but for a company that many people wrote off from the very beginning, it’s an impressive feat.

Despite being a hardware, media, interactive software, product design, social connection, apparel and logistics company, according to its S-1, the future of Peloton relies on its talent. Not the employees developing the bikes and software but the 29 instructors teaching its digital fitness courses. Ally Love, Alex Toussaint and the 27 other teachers have developed cult followings, fans who will happily pay Peloton’s steep $39 per month content subscription to get their daily dose of Ben or Christine.

“To create Peloton, we needed to build what we believed to be the best indoor bike on the market, recruit the best instructors in the world, and engineer a state-of-the-art software platform to tie it all together,” founder and CEO John Foley writes in the IPO prospectus. “Against prevailing conventional wisdom, and despite countless investor conference rooms full of very smart skeptics, we were determined for Peloton to build a vertically integrated platform to deliver a seamless end-to-end experience as physically rewarding and addictive as attending a live, in-studio class.”

Peloton succeeded in poaching the best of the best. The question is, can they keep them? Will competition in the fast-growing fitness technology sector swoop in and scoop Peloton’s stars?

In other news

Last week I published a long feature on the state of seed investing in the Bay Area. The TL;DR? Mega-funds are increasingly battling seed-stage investors for access to the hottest companies. As a result, seed investors are getting a little more creative about how they source deals. It’s a dog-eat-dog world out there, and everyone wants a stake in The Next Big Thing. Read the story here.

Rounds of the week

- ThoughtSpot hauled in a $248M round at a $1.95B valuation

- Bedding startup Boll & Branch raised $100M

- Credit Sesame, a platform for managing loans, picked up $43M

- Mews grabbed a $33M Series B to modernize hotel administration

- Koru Kids closed a £10M Series A for its childcare platform

- Urbvan raised $9M for its private shuttle service in Mexico

- The popular shoe brand (among VCs) Atoms nabbed $8.1M

- Consider, an email service for startups, raised $5M from Kleiner Perkins

Time to Disrupt

Don’t miss out on our flagship Disrupt, which takes place October 2-4. It’s the quintessential tech conference for anyone focused on early-stage startups. Join more than 10,000 attendees — including over 1,200 exhibiting startups — for three jam-packed days of programming. We’re talking four different stages with interactive workshops, Q&A sessions and interviews with some of the industry’s top tech titans, founders, investors, movers and shakers. Check out our list of speakers and the Disrupt agenda. I will be there interviewing a bunch of tech leaders, including Bastian Lehmann and Charles Hudson. Buy tickets here.

Listen

This week on Equity, TechCrunch’s venture capital-focused podcast, we had Floodgate’s Iris Choi on to discuss Peloton’s upcoming IPO. You can listen to it here. Equity drops every Friday at 6:00 am PT, so subscribe to us on Apple Podcasts, Overcast and Spotify.

Learn

We published a number of new deep dives on Extra Crunch, our paid subscription product, this week. Here’s a quick look at the top stories:

- How Pivotal got bailed out by fellow Dell family member, VMware by Ron Miller

- How to use Amazon and advertising to build a D2C startup by Matt Altman and Tyler Elliston

- Customer success isn’t an add-on — Start early to win later. By Dale Chang and Jay Nathan.

from Startups – TechCrunch https://ift.tt/2ZHyp9N

via IFTTT

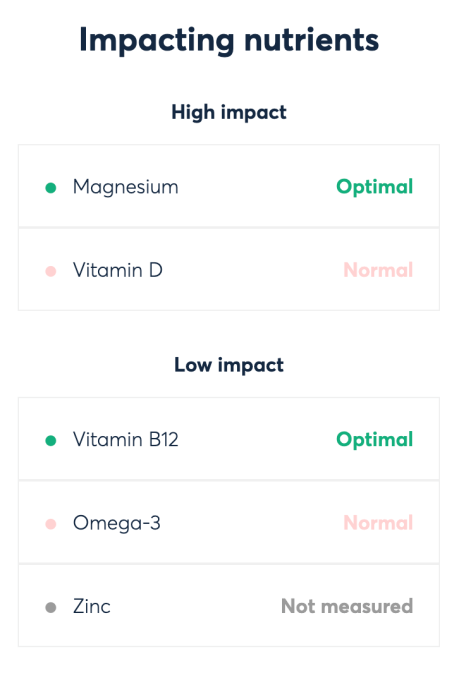

I had the opportunity to try out the test myself. It’s pretty simple to do. You just open up a little pear-shaped device, pop it on your arm and then press it to engage and get it to start collecting your blood. After it’s done, plop it in the provided medical packaging and ship it off to a Baze contracted lab.

I had the opportunity to try out the test myself. It’s pretty simple to do. You just open up a little pear-shaped device, pop it on your arm and then press it to engage and get it to start collecting your blood. After it’s done, plop it in the provided medical packaging and ship it off to a Baze contracted lab.

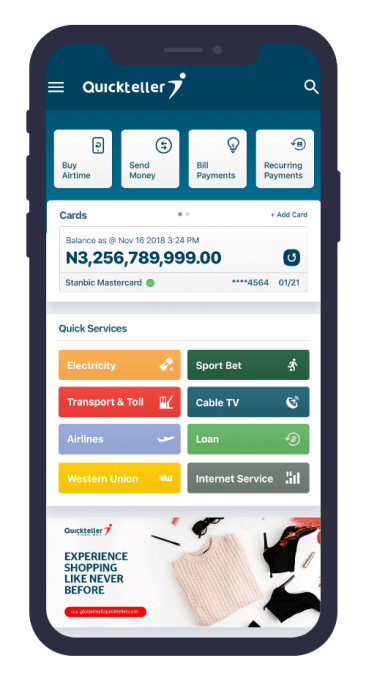

Another facet to a possible Interswitch IPO is its potential to spark more corporate venture arm and acquisition activity in African fintech, which as a sector receives the bulk of the continent’s startup capital. Interswitch launched a venture arm in 2015

Another facet to a possible Interswitch IPO is its potential to spark more corporate venture arm and acquisition activity in African fintech, which as a sector receives the bulk of the continent’s startup capital. Interswitch launched a venture arm in 2015