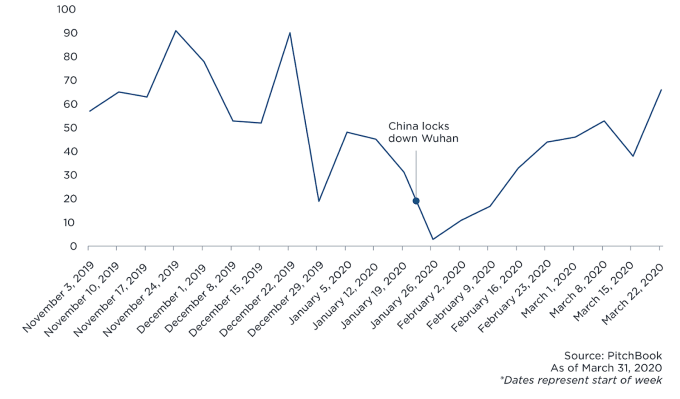

For the past month, VC investment pace seems to have slacked off in the U.S., but deal activities in China are picking up following a slowdown prompted by the COVID-19 outbreak.

According to PitchBook, “Chinese firms recorded 66 venture capital deals for the week ended March 28, the most of any week in 2020 and just below figures from the same time last year,” (although 2019 was a slow year). There is a natural lag between when deals are made and when they are announced, but still, there are some interesting trends that I couldn’t help noticing.

While many U.S.-based VCs haven’t had a chance to focus on new deals, recent investment trends coming out of China may indicate which shifts might persist after the crisis and what it could mean for the U.S. investor community.

Image Credits: PitchBook

Just like SARS in 2003 coincided with the launch of Taobao and pushed Jingdong to transform from an offline retailer into online giant JD.com, there may be dark horses waiting to break out when this pandemic is over. Paraphrasing “A Tale of Two Cities” — this is the worst time, but also maybe the best time.

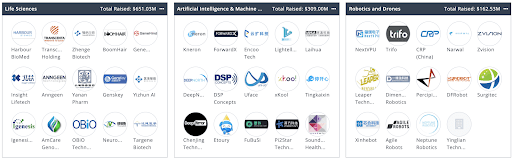

In addition to obvious trends about food delivery, digital content, gaming and other sectors, I have identified five other trends that are closing the most deals in Q1 on the early-stage side that could define the post-pandemic environment: e-commerce, edtech, robotics and advanced manufacturing, healthcare IT/life Science and AI/enterprise SaaS.

![]()

No comments:

Post a Comment

Thank You for your Participation