Accel, one of the world’s most influential venture capitalist firms, is becoming more bullish on India.

The Silicon Valley-headquartered firm, which largely focuses on early stage investments, said today it has closed $550 million for its sixth venture fund in India.

This is a significant amount of capital for Accel’s efforts in India, where it began investing 15 years ago and has infused roughly $1 billion through all of its previous funds combined.

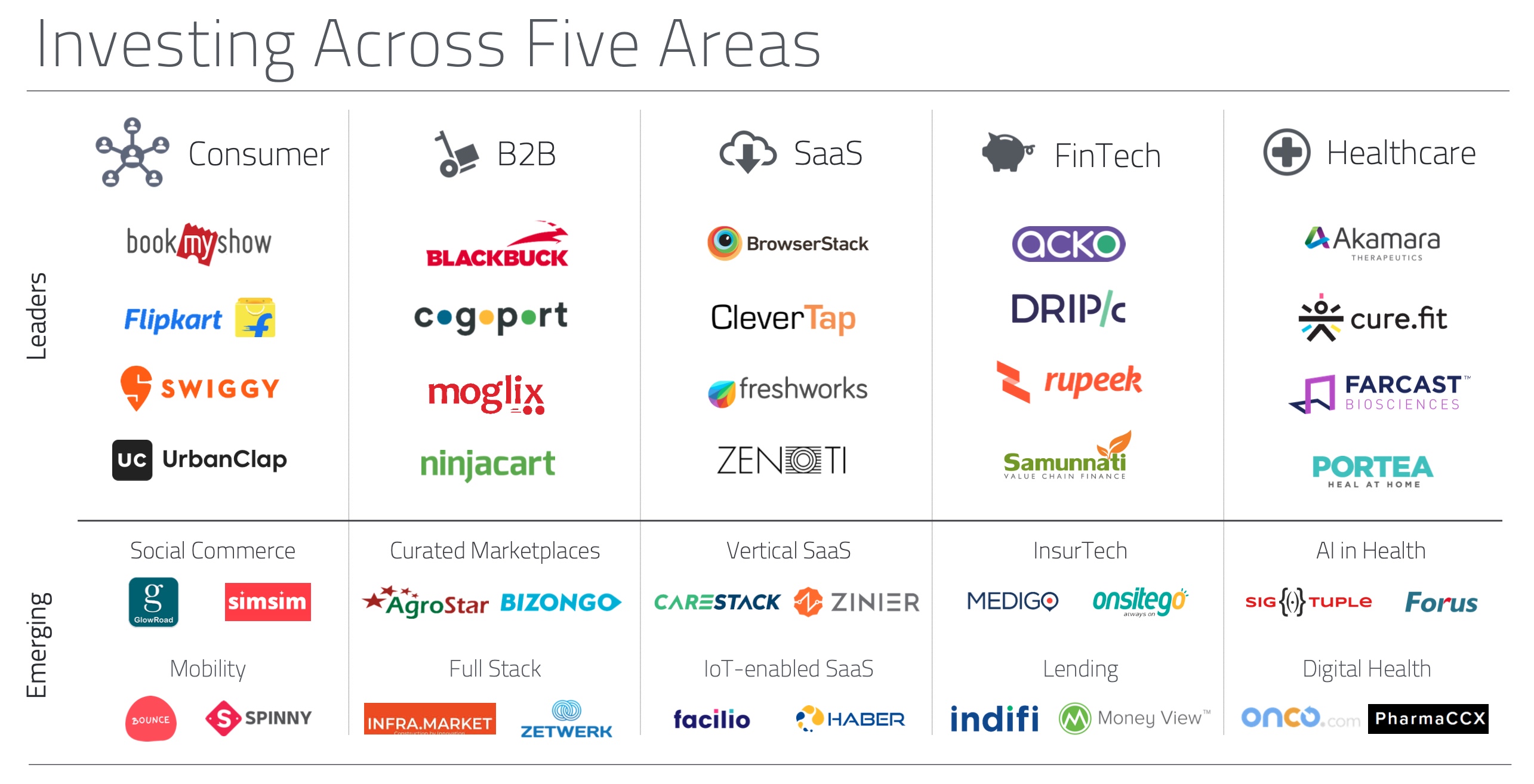

Anand Daniel, a partner for Accel in India, told TechCrunch in an interview that the VC fund will continue to focus on identifying and investing in seed and early stage startups.

But the fund realized that it needed more money so that it could actively participate in follow-on rounds (later stage financing rounds) of its portfolio startups. The announcement today follows Accel’s similar recent push in Europe and Israel, where it closed a $575 million fund.

Like in many other markets, Accel’s track record in India is quite impressive. It participated in the seed financing round of e-commerce firm Flipkart, which was then valued at $4 million post-money. Walmart bought majority stake in Flipkart last year for $16 billion.

Accel, which has nine partners and more than 50 members in total in India, also invested in the seed round of SaaS giant Freshworks, which is now valued at over $3 billion, food delivery startup Swiggy, also valued at north of $3 billion, and recently turned unicorn BlackBuck.

The VC firm says 44 startups in its India portfolio today are valued at over $100 million. In total, including Flipkart’s $21 billion market value, Accel’s portfolio firms have created $44 billion in market value.

More to follow…

from Startups – TechCrunch https://ift.tt/2r5nQC4

via IFTTT

No comments:

Post a Comment

Thank You for your Participation