Illinois’s startup market in 2018 was very strong, and it’s not slowing down as we settle into 2019. There’s already almost $100 million in new VC funding announced, so let’s take a quick look at the state of venture in the Land of Lincoln (with a specific focus on Chicago).

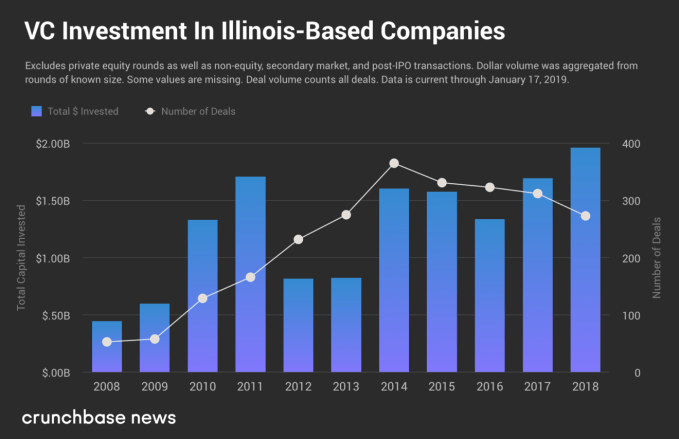

In the chart below, we’ve plotted venture capital deal and dollar volume for Illinois as a whole. Reported funding data in Crunchbase shows a general upward trend in dollar volume, culminating in nearly $2 billion worth of VC deals in 2018; however, deal volume has declined since peaking in 2014.1

Chicago accounts for 97 percent of the dollar volume and 90.7 percent of total deal volume in the state. We included the rest of Illinois to avoid adjudicating which towns should be included in the greater Chicago area.

In addition to all the investment in 2018, a number of venture-backed companies from Chicago exited last year. Here’s a selection of the bigger deals from the year:

- After raising $57 million in total venture funding, meal kit delivery company Home Chef was acquired by grocery chain Kroger for $200 million.

- Government technology platform provider CityBase was acquired by GTY Technology Holdings for $160 million. The company had raised $13.1 million from investors prior to the acquisition.

- Maestro Health, an employee benefits company, was acquired for $155 million by insurance giant AXA Group. Maestro Health had raised roughly $53 million in known venture funding.

Crain’s Chicago Business reports that 2018 was the best year for venture-backed startup acquisitions in Chicago “in recent memory.” Crunchbase News has previously shown that the Midwest (which is anchored by Chicago) may have fewer startup exits, but the exits that do happen often result in better multiples on invested capital (calculated by dividing the amount of money a company was sold for by the amount of funding it raised from investors).

2018 was a strong year for Chicago startups, and 2019 is shaping up to bring more of the same. Just a couple weeks into the new year, a number of companies have already announced big funding rounds.

Here’s a quick roundup of some of the more notable deals struck so far this year:

- On Thursday, commercial real estate search firm Truss raised $15 million in additional financing, extending the Deerfield, IL-based company’s Series A round. The deal was led by Boston-based General Catalyst. The deal brings Truss’s total equity and debt funding to more than $24 million.

- Learning management system company BenchPrep announced $20 million in a Series C round co-led by Chicago-based Jump Capital and Bay Area-based Owl Ventures, LP. Part of that capital reportedly comes in the form of debt. The SEC filing for the round, dated December 2018, discloses that $14.53 million was raised in an equity offering, of which $2,999,999 was used to buy shares from “certain executive officers” at the company.

- Delivery service Bringg raised $25 million in Series C funding, which was led by Next47. Other investors in the deal include The Coca-Cola Company, Salesforce Ventures and Aleph. Bringg’s customers include Walmart and McDonald’s. The company has raised at least $52 million in known venture funding to date.

Besides these, a number of seed deals have been announced. These include relatively large rounds raised by 3D modeling technology company ThreeKit, upstart futures exchange Small Exchange and 24/7 telemedicine service First Stop Health.

Globally, and in North America, venture deal and dollar volume hit new records in 2018. However, it’s unclear what 2019 will bring. What’s true at a macro level is also true at the metro level. Don’t discount the City of the Big Shoulders, though.

- Note that many seed and early-stage deals are reported several months or quarters after a transaction is complete. As those historical deals get added to Crunchbase over time, we’d expect to see deal and dollar volume from recent years rise slightly.

from Startups – TechCrunch https://tcrn.ch/2FAGxDt

via IFTTT

No comments:

Post a Comment

Thank You for your Participation