Meet Upflow a French startup that wants to help you deal with your outstanding invoices — the company first started at eFounders. If you’re running a small business, chances are you’re either wasting a ton of time or a ton of money on accounts receivable.

Most companies currently manage invoices using Excel spreadsheets, outdated banking interfaces and unnecessary conversations. Every time somebody signs a deal, they generate an invoice and file it in a spreadsheet somewhere.

Some companies will pay a few days later. But let’s be honest. Too many companies wait 30 days, 40 days or even more before even thinking about paying past due invoices. You end up sending emails, calling your clients and wasting a ton of time just collecting money. You might even feel bad about asking for money even though you already signed a deal.

In France, most companies use bank transfers to pay invoices. But business banking APIs are not there yet. It means that you have to log in to a slow banking website every day to check if somebody paid you. You can then tick a box in an Excel spreadsheet.

If everything I described resonates with you, Upflow wants to manage your invoices for you. It doesn’t replace your bank account, it doesn’t generate invoices for you. It integrates seamlessly with your existing workflow.

After signing up, you can send invoices to your client and cc Upflow in your email thread. Upflow then uses optical character recognition and automatically detects relevant data — the customer name, the amount, the due date, etc.

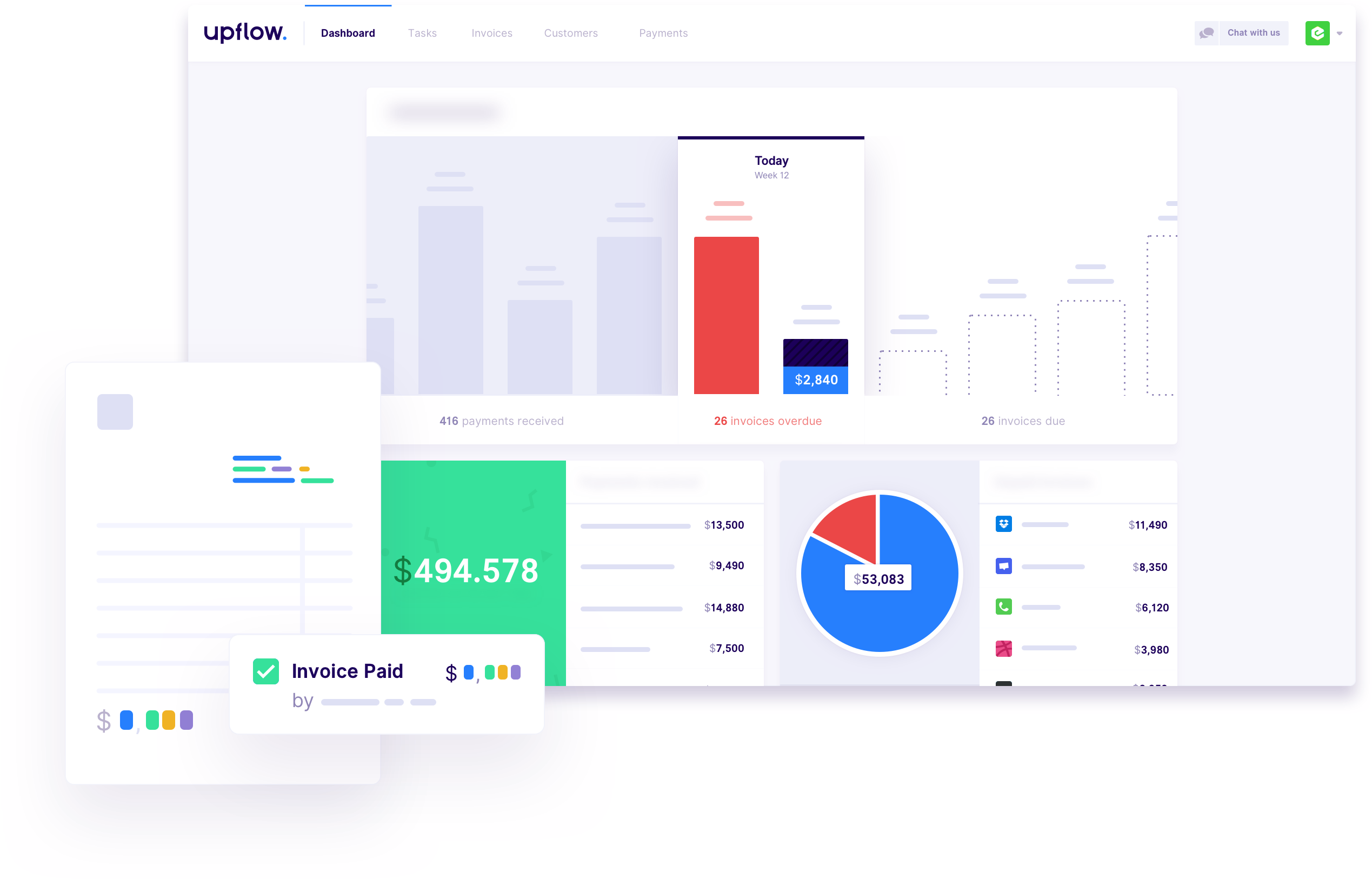

You can view all your outstanding invoices in Upflow’s interface to see where you stand. The service gives you a list of actionable tasks to get your money. For instance, Upflow tells you if you have overdue payments and tells you to contact your client again.

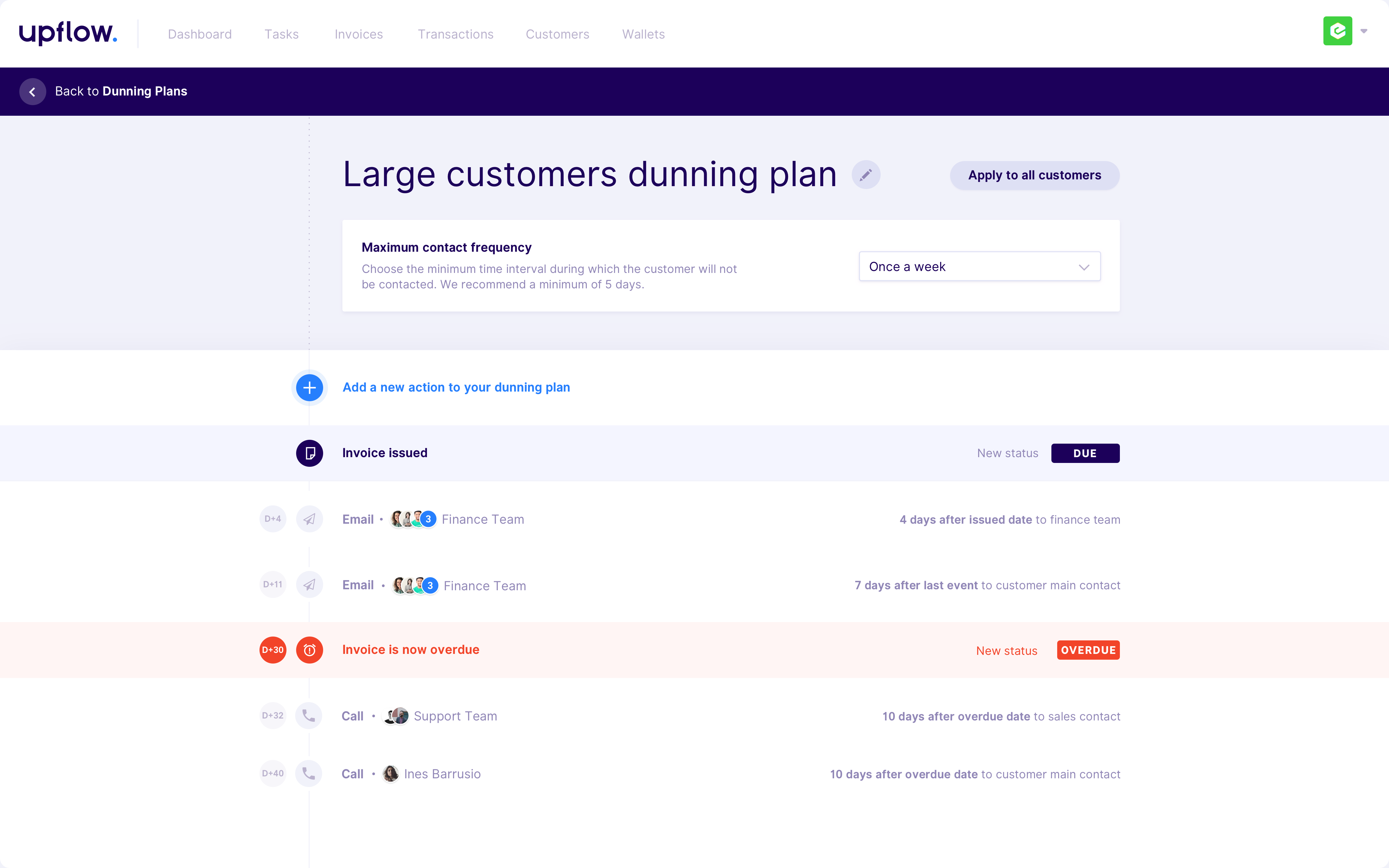

You can set up different rules depending on your clients. For instance, if you have many small clients, you can automate some of those messages. But if you only work with a handful of clients, you want to make sure that somebody has manually reviewed each message before Upflow sends them.

By default, you write your emails in Upflow so that your other team members can see what happened. You can browse invoices by client to see if somebody has multiple unpaid invoices. Upflow lets you assign actions to a particular team member if they’re more familiar with this specific client.

But all of this is just one part of the product. Upflow also generates banking information with the help of Treezor. This way, you can put your Upflow banking information on your invoices.

When a customer pays you, Upflow automatically matches invoices with incoming payments. This feature alone lets you save a ton of time. The startup transfers money back to your company’s bank account every day.

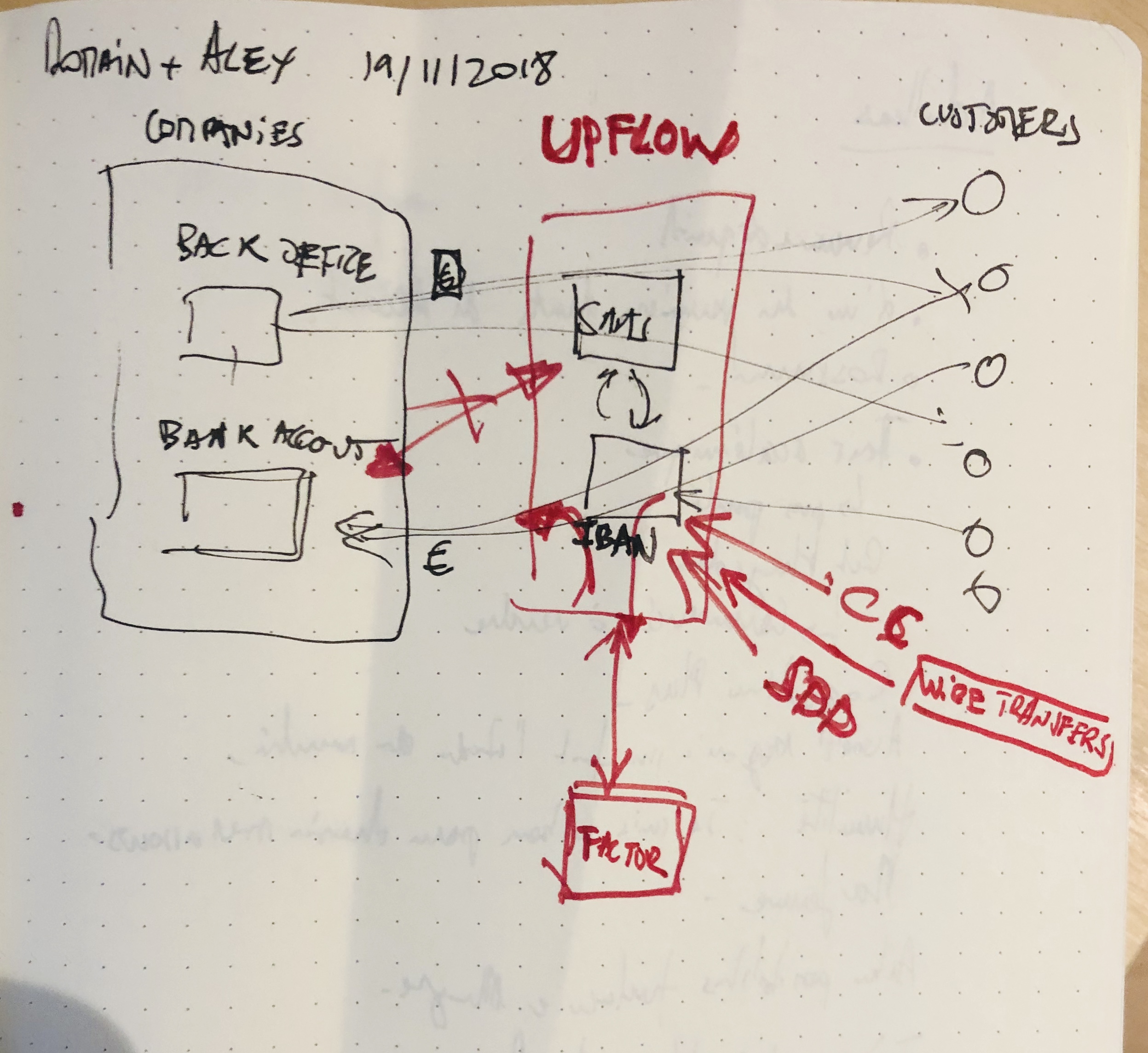

Upflow co-founder and CEO Alexandre Louisy drew me the following chart when we met. It’s probably easier to understand after reading my explanations:

In other words, Upflow has created a brick that sits between your company’s back office and your customers. Eventually, you could imagine more services built on top of this brick as Upflow is learning many things on your company.

According to Louisy, small and medium companies really need this kind of product — and not necessarily tech companies. Those companies don’t have a lot of money on their bank accounts, don’t have a big staff and need to save as much time as possible.

Now let’s see if it’s easy to sell a software-as-a-service solution to a family business that has been around for decades.

from Startups – TechCrunch https://ift.tt/2PR4ig6

via IFTTT

No comments:

Post a Comment

Thank You for your Participation