Government services, for many, epitomize the worst of bureaucracy: they are, at their low point, large, lumbering organizations working under strained budgets, staffed by lifer employees who don’t get much say in improving things, and lots of paperwork. But as ageing public information infrastructure grinds to a halt and public services start making the switch to digital, that image is slowly starting to change, and the tech companies helping this along are reaping some of the rewards.

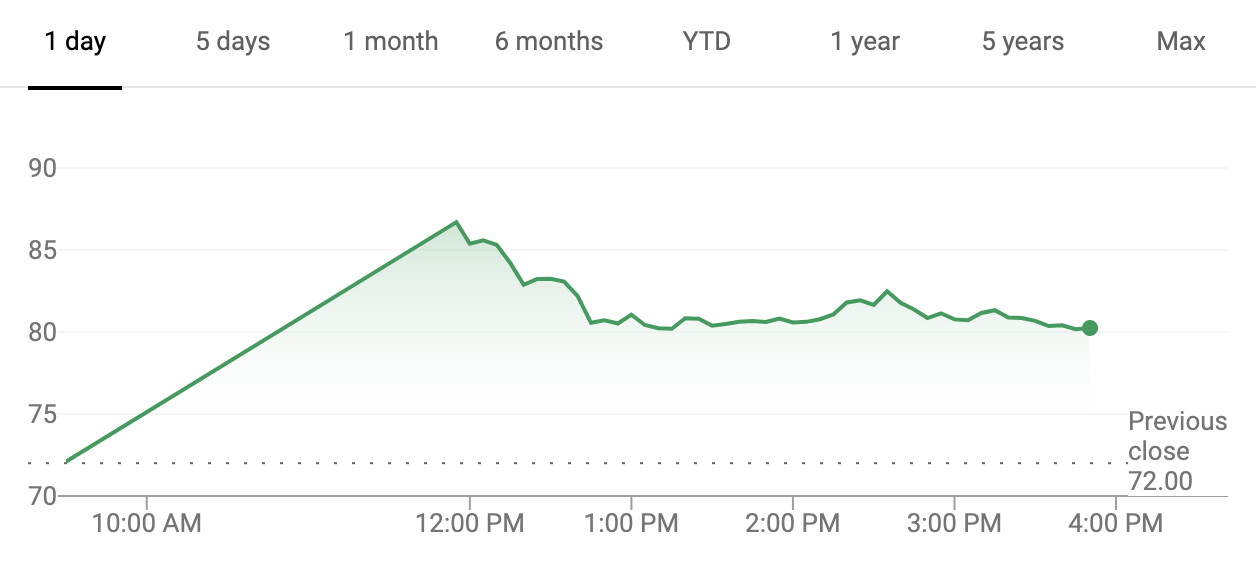

Today one them, PayIt — which has designed a platform to take payments and produce related documentation for public services through web and mobile interfaces — announced that it has raised a hefty funding round of over $100 million to tap that opportunity.

PayIt’s platform is currently operational in the US and covers a variety of applications that fall under the general category of public services that require government organizations and agencies to take money from us, and issue us with certificates and other documents confirming we have done something official. They include Courts and Citations, Environmental Services, Health and Human Services, Motor Vehicle, Parks and Wildlife Services, Professional Licensing, Public Safety, Taxes, Turnpike and Tolling, and Utilities.

The plan for PayIt will be to expand that list to cover more use cases, to win more business in the US, and to also begin the process of breaking into more international markets.

The funding is coming from a single investor, Insight Partners (which used to go by Insight Venture Partners), and it is also notable because of some of the funding context.

Since its founding in 2013, PayIt had only raised $11 million, John Thomson — the CEO who co-founded and runs the company with Michael Plunkett (COO) in Kansas City — told me in an interview.

And in case you are wondering, Thomson added that the reason they’re not disclosing a more exact funding figure — or PayIt’s valuation — is because the company doesn’t want the financial aspects to be the focus: both because he wants this to be about expansion, and because he doesn’t want to give too much information to competitors.

Indeed, while the market is massive — in the US alone, Thomson estimates that some $2 trillion flows between public services and constituents annually — it is also crowded with payment companies that want to tap some of that for themselves.

Competitors include other payment platforms that work with government services such as Aliant, other payment providers like Stripe and PayPal, companies like Visa, and sometimes even the governments itself. Thomson does not what PayIt’s own share of the pie is except to note that it is handling a “small but rapidly growing percentage of the market.”

As citizens, we all know some of the pain points of older systems: they might require in-person visits or snail mail to make payments and procure various official documents. (DMV appointments, for one, can take months to sort out.) As Thomson describes it, what’s going on under the hood is equally as inefficient and slow moving.

“To do business with the government — whether its US, state or local — the entire burden in many cases is placed on constituents,” Thomson said. Behind the scenes, it’s also bad. There can be “as many as six or seven systems in use to handle a request, a payment and more.”

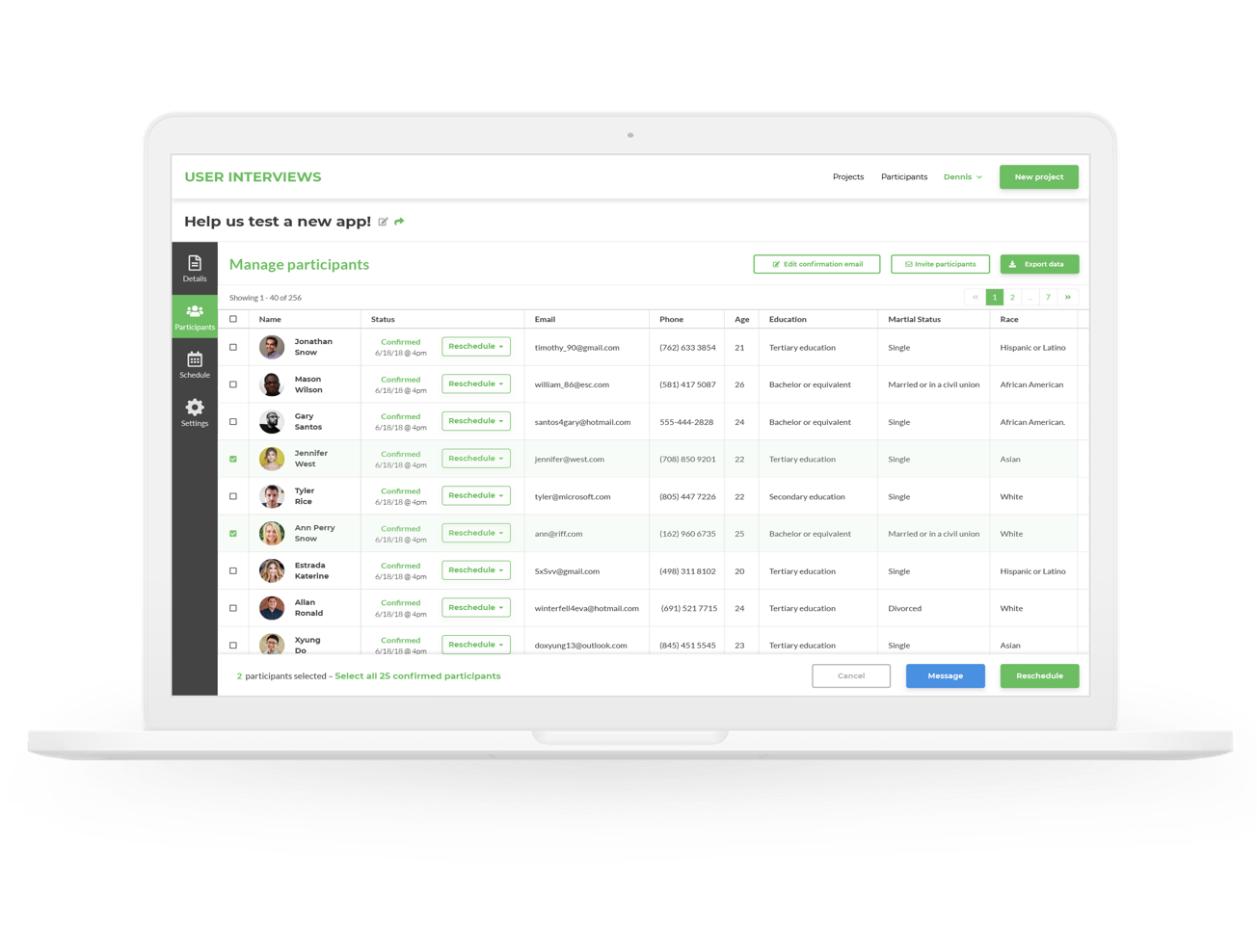

The idea is that PayIt has built a platform that can integrate all of that into a single process, behind a single front end. “Payments happen in the form of a wallet,” he said, adding that PayIt handles sensitive information in the cloud and doesn’t require users to re-enter too many details, or for too many organizations to have to hand off information between each other to complete a payment subsequent document order. “Consumers love it because it’s like interacting with a business in the private sector,” he said.

PayIt’s notable for straddling two big areas — fintech and govtech. While the former has seen a ton of innovation that has mirrored the growth of the internet overall, tech companies (and governments) have really only started to scratch the surface with the latter. It will be interesting to see how this develops both in terms of innovation, but also where people will potentially draw a line on too much centralised and digitised information. Recent moves in India around Aadhar — which is now the world’s largest biometric ID system — have been more than a little controversial.

For now, however, there are a lot of incremental processes to fix and make efficient, and that is where PayIt sits for now.

Insight Partners is an interesting investor for PayIt in that regard. The VC has a track record for backing startups that are using tech to disrupt and rethink legacy infrastructure, with previous investments including WordPress’s Automattic, BlaBlaCar and N26 in Europe, Docusign and many more.

“What excited us most about the PayIt platform is its ability to scale and make a true impact on a broad base of stakeholders,” said Ryan Hinkle, Managing Director at Insight Partners, in a statement provided to TechCrunch.

“We’ve all dreaded having to wait in line for a new driver’s license, or jump through hoops to pay for a parking ticket. It’s clear that with PayIt, that doesn’t have to be the reality. PayIt seeks to dissolve those stressful interactions making processes seamless and simple for constituents and governments, allowing issues to be resolved and revenue to be collected efficiently. At Insight Partners, we’re looking forward to helping John and the team scale the best-in-class platform they’ve already built, and reach new constituents and governments with these solutions.”

from Startups – TechCrunch https://ift.tt/2CHpxZ0

via

IFTTT